Step through the Archway

An Overview of Archway – The “Thin” Smart Contract Platform

Several projects in the Cosmos ecosystem have appeared with the shared vision of giving developers a controlled and simplified VM environment in which to develop their Cosmos-based applications.

This article gives an overview of Archway, a Cosmos native platform for interoperable smart contracts. It also compares its features to peers in the Cosmos ecosystem, such as Juno and Agoric.

Key takeaways

- Archway introduces a novel system for distributing protocol rewards across network participants.

- dApps built on Archway can allocate the rewards (e.g. gas) they accrue in whichever way they deem to be the most beneficial to their ecosystem.

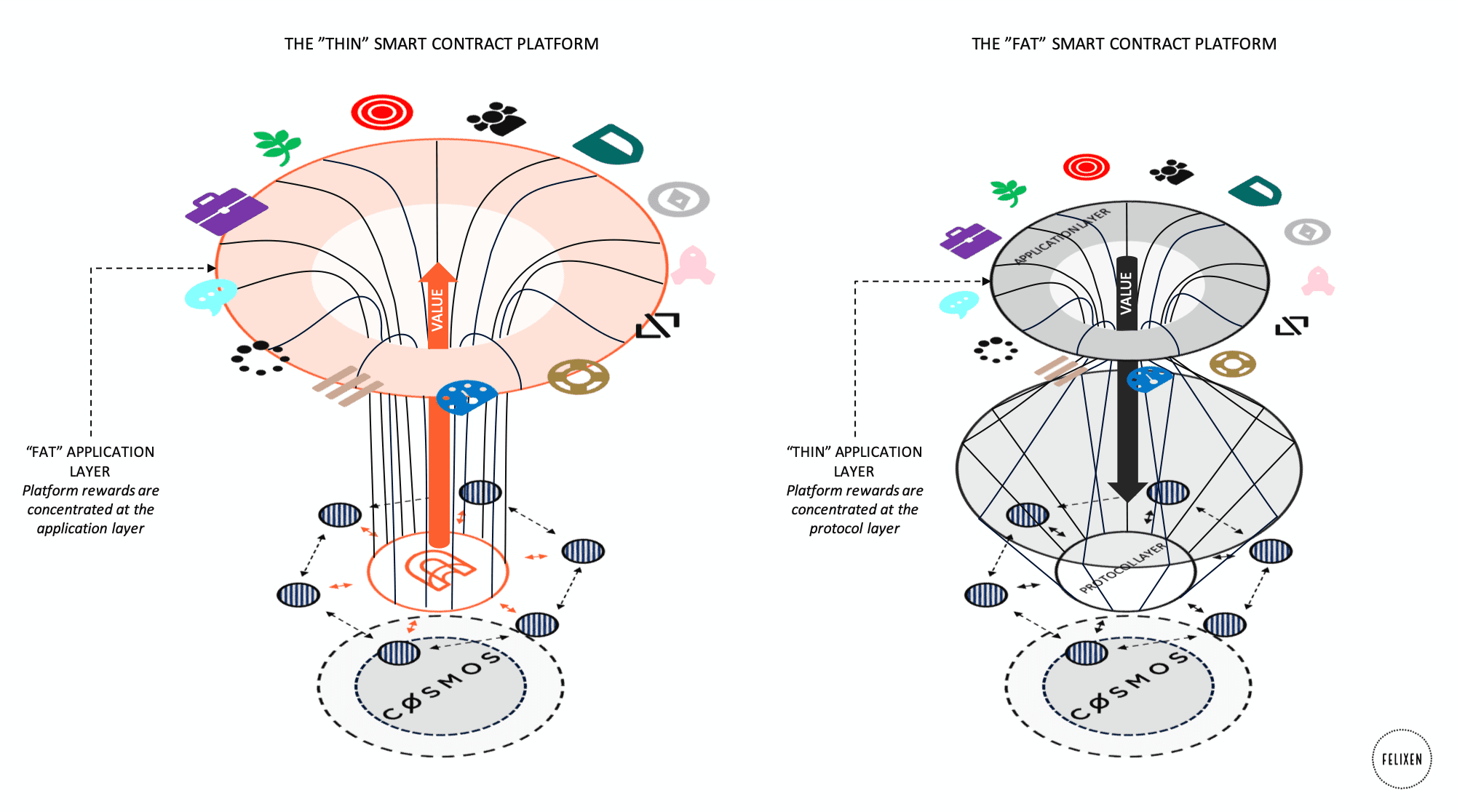

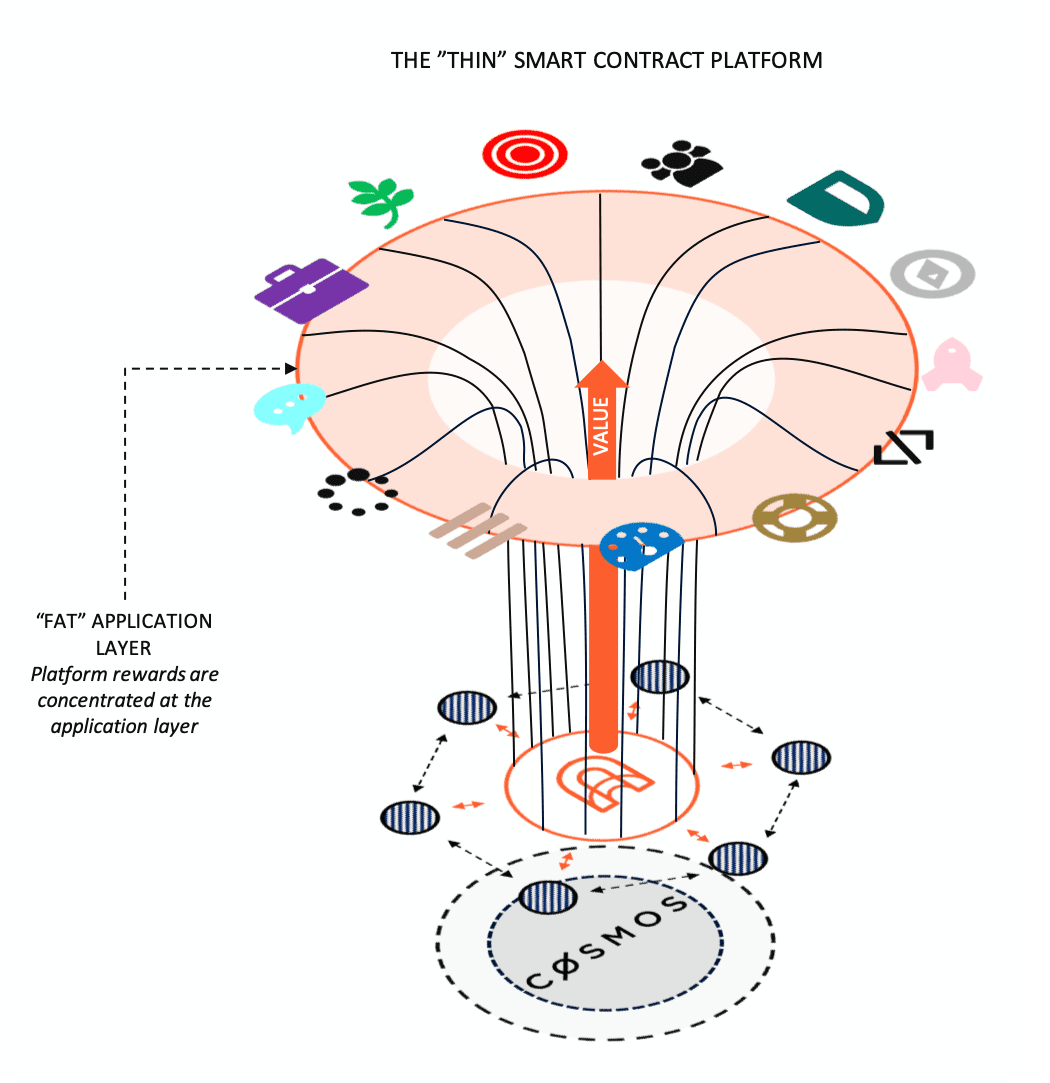

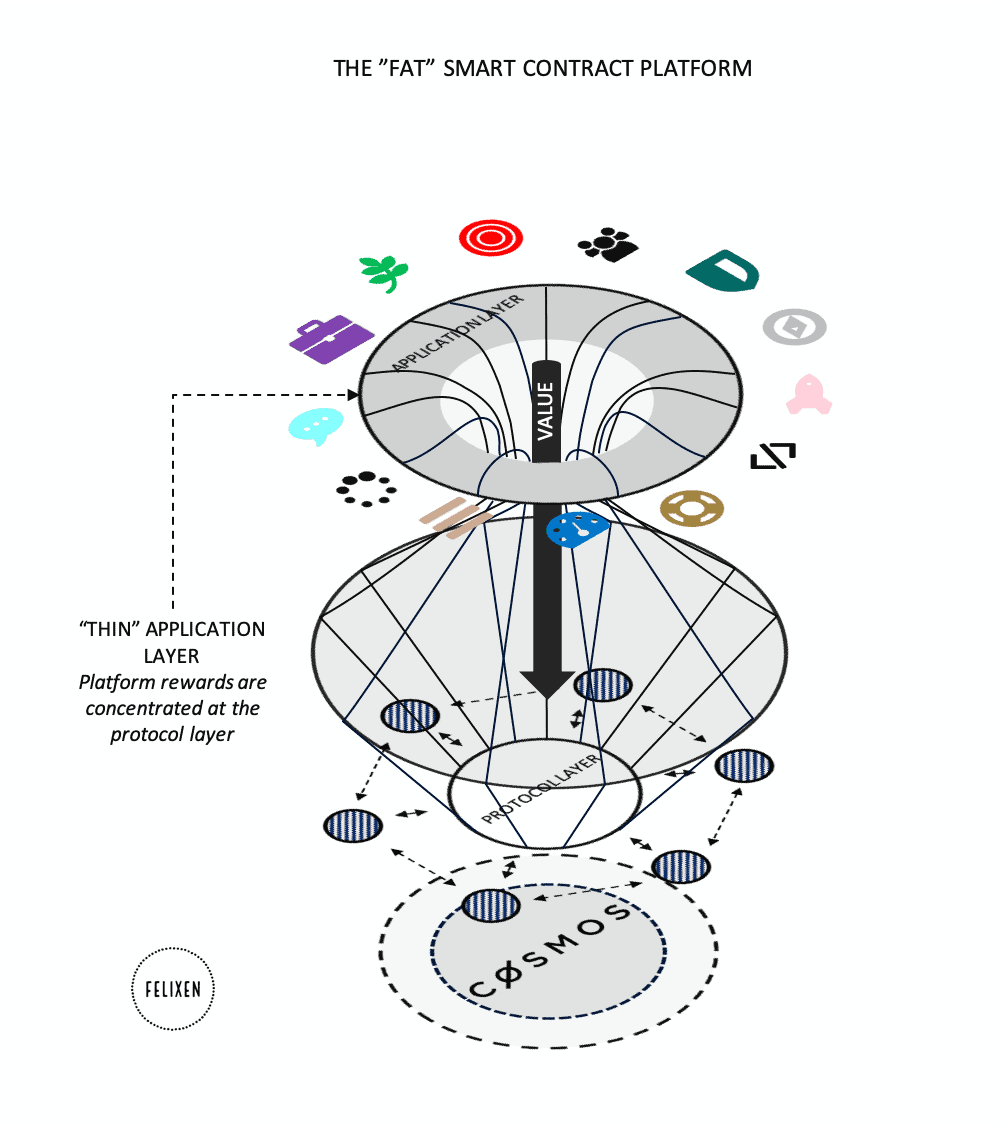

- Archway accommodates “thin” protocols and “fat” applications where value is accrued at the application layer rather than at the protocol layer, an inverse relationship to that which is offered by most current smart contract platforms.

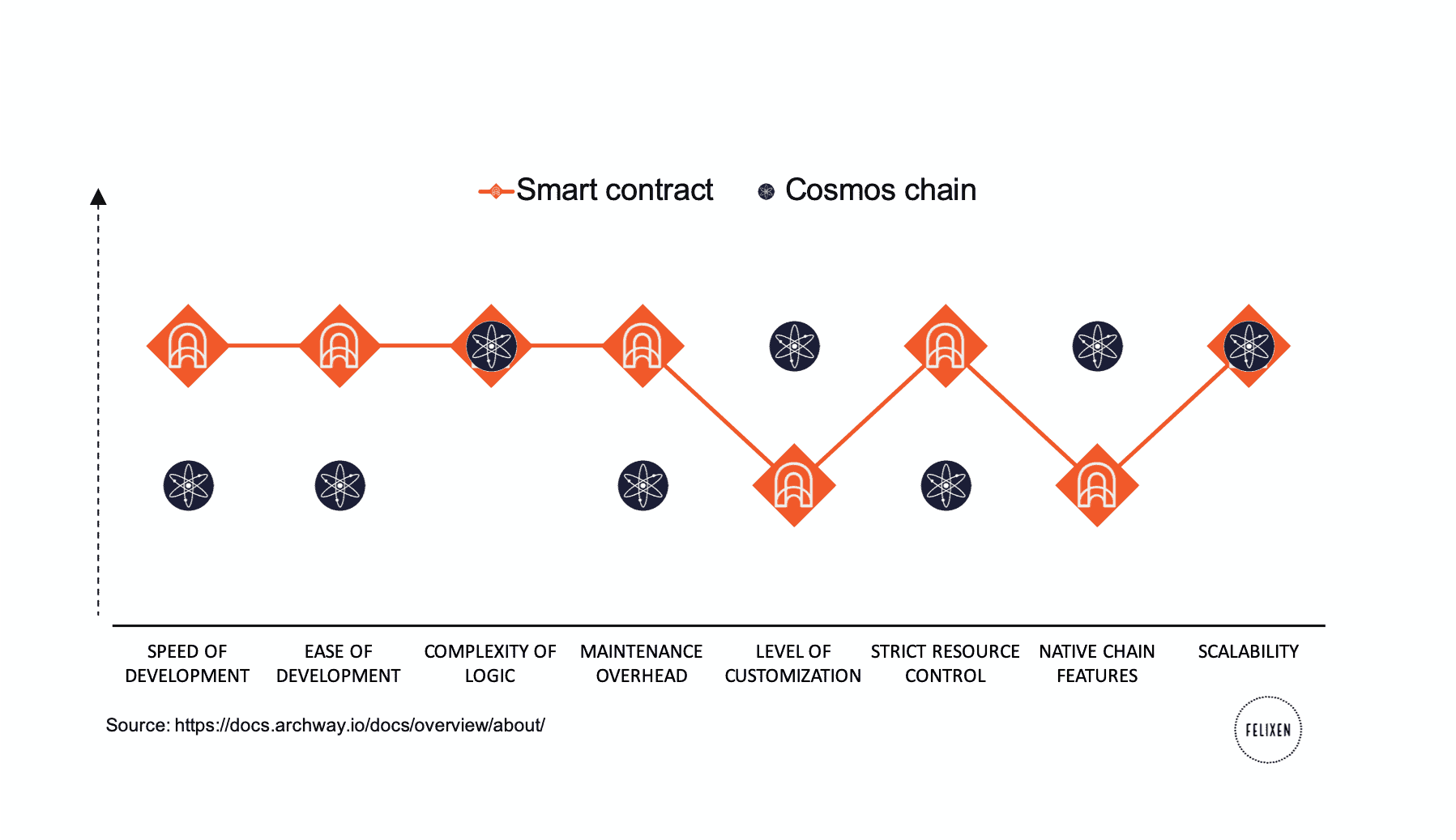

- Smart contract platforms such as Archway offers increased speed and ease of development in exchange for lower level of customization and fewer native chain features, when compared to sovereign cosmos chains.

- Archway enables new use cases such as gasless transactions and DeFi 2.0 functionality, which may unlock new paths for onboarding dApps and users that value high levels of interactivity and small-size transactions – such as in the gaming and entertainment niche.

Abbreviations

- Smart contract platforms = platforms for interoperable smart contracts that give developers a controlled and simplified VM environment in which to develop their applications.

- dApps = decentralized applications that combine a smart contract and a frontend user interface.

- Application layer = where contract calls are sent from an ecosystem of dApps.

- Protocol layer = where execution of transactions and data referencing is accommodated by a set of validators.

- IBC = Inter-Blockchain Communication protocol, a cross-chain communication protocol for transferring value and data between independent networks.

The advantages of smart contracts

Smart contract platforms allow developers to build decentralized financial applications (dApps) and tokens that are stored on a blockchain. There are currently many approaches that are explored in an attempt to make blockchains increasingly available for developers and scalable for the masses.

As a preface, consider the following tradeoffs between building smart contracts versus independent Cosmos blockchains.

Archway natively supports CosmWasm and IBC so that users can exchange assets and data with other Cosmos-enabled chains. dApps that build on Archway connect directly into IBC without additional development or the need to spin up an independent cosmos chain, similar to how Juno or Agoric works today.

Because there is no need to find and coordinate a new set of validators, the main advantage of smart contract platforms lies in the speed and ease of setting up and deploying applications.

The potential drawback of this is the lacking ability for technical tailoring and customization that would otherwise be available to a sovereign chain. However, with Archway adding additional VM support and the integrated Starport toolkit allowing chain migrations, the jury is still out in terms of what or how projects will prioritize to deploy in the medium to long term future.

Rewards and network fees

In the traditional smart contract platform model, network fees (“gas”) are charged based on the amount of computational processing required by on-chain transactions. These protocol-based rewards are then either burned or distributed across the active validator set.

The native network incentive structures are usually pre-set at genesis but subject to change based on the growth of the protocol.

This results in that the majority of the value capture of the network happens at the protocol level (see fat protocol thesis), while dApps receive a “thin” slice of the value captured.

Instead, value for dApps is mostly captured through token value appreciation or fund raising activities. Apart from this, developers or creators on these platforms may also receive rewards from:

⚡️ Community pools that may support initiatives that add long-term value to the protocol.

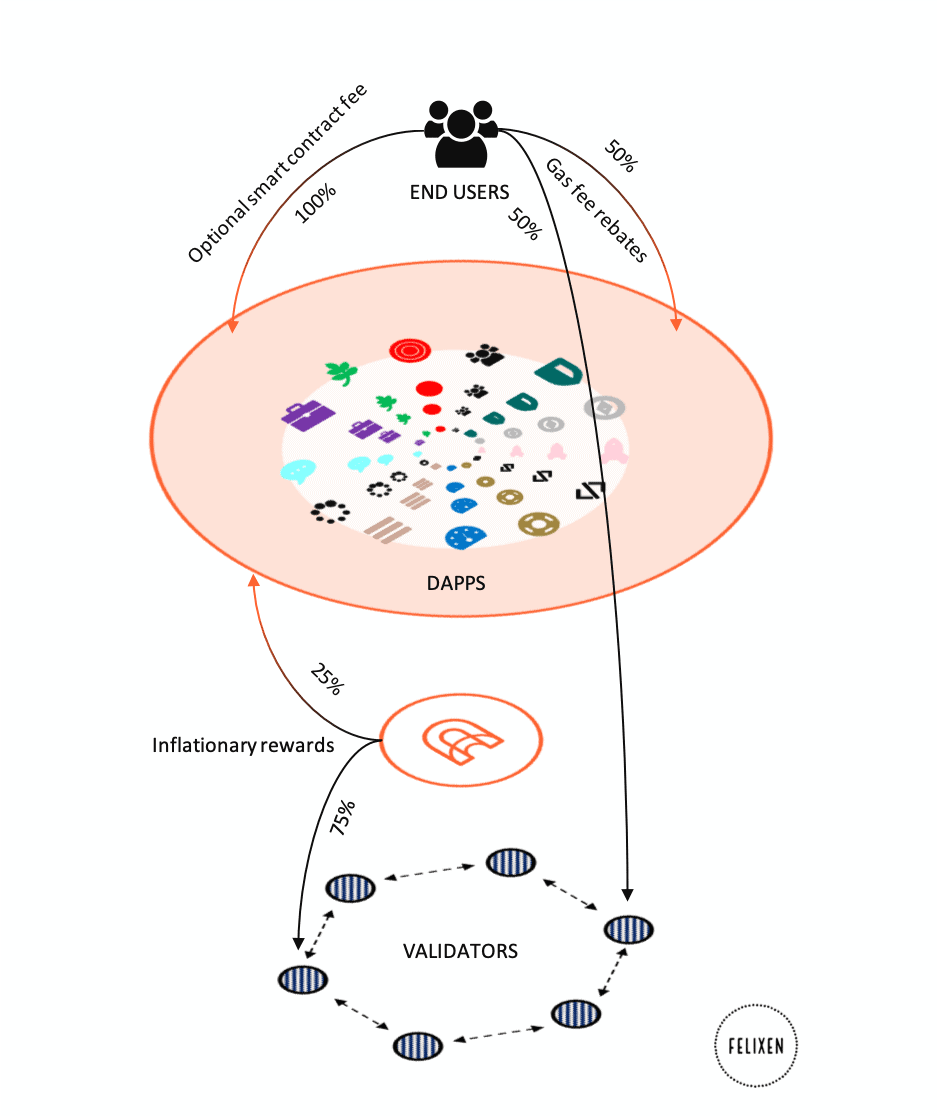

In the Archway model, dApps earn a portion of transaction fees and inflationary rewards in exchange for their contributions to the network. Moreover, they can choose freely whether to distribute the rewards back to the end-user, the dApp team or to its community.

dApps built on Archway may receive rewards from:

- Smart contract fees = a contract fee optionally set by the smart contract developer.

- Gas fee rebates = Gas fees (denominated in $ARCH token) paid by users for interacting with contracts.

- Inflationary rewards = 7-20% yearly inflation depending on the ratio of tokens that are staked on the network. Note: for dApps, inflation rewards are distributed proportionally based on the relative amount of gas fees that each dApp generates. For instance, a dApp that is responsible for 1% of gas consumption would be awarded 1% of the available pool (with a max reward cap to avoid spam attacks, and with the limitation that each dApp cannot earn rewards > than the total gas it generates).

The distribution of these fees is outlined above.

⚡️ Smart contract fees (optional)

dApp share of rewards

Validator share of rewards

⚡️ Gas fee rebates

dApp share of rewards

Validator share of rewards

⚡️ Share of inflationary rewards

dApp share of rewards

Validator share of rewards

The smart contract fee is optional, meaning it can be set to 0. But in the case it isn’t 0, it is 100% distributed to the dApp.

With the functionality offered by pool accounts, developers can choose to take the rewards or give the gas rebate to end-users to subsidize transaction costs. For instance, a developer can choose to automatically redirect funds earned by the dApp, including gas rebates, inflation rewards, and smart contract fees, straight to governance token holders.

In the traditional model of smart contract platforms, the dApp share of protocol rewards is low or non-existent. Most value capture is located at the protocol layer – making it “fat”. Meanwhile, network fees are not shared with the application layer – making it “thin”.

In the Archway model, 50% of gas fees and 25% of inflationary rewards are distributed back to the application layer – making it “Fat”. While some dApps such as SushiSwap have implemented similar functionality, Archway makes it possible to redistribute governance rewards at the protocol level itself. As a result, validators earn less share of the rewards at the protocol layer – making it “Thin” in comparison to previous models.

Use cases for dApps

Archway essentially allows for new ways of distributing incentives across end-users, the DAO or founding team, community and network participants. In terms of where rewards can be redistributed, Archway itself gives examples including:

- Governance token holders

- Used to support core development teams

- Cover users’ gas fees

- Seed liquidity pools

- Contribute to a community DAO

- Open project bounties

- Sponsor events or hackathons, and more.

Enabling the redistribution of application rewards toward token holders is often referred to as DeFi 2.0. In summary, it allows for increased liquidity and capital efficiency, more user involvement/governance, and stronger ponzi-nomics.

The differences between new and old DeFi thinking is summarized by Cointelegraph as follows:

Connection between end-users

DeFi 2.0

DeFi 1.0

Ecosystem

DeFi 2.0

DeFi 1.0

Incentive schemes

DeFi 2.0

DeFi 1.0

Governance pattern

DeFi 2.0

DeFi 1.0

Scope for innovation

DeFi 2.0

DeFi 1.0

Future outlook

For Archway, these are future topics and roadmap deliverables to keep an eye on:

- Integrations with other major layer 1 networks, including Ethereum, Solana, Polkadot, and Celo that will let the Archway ecosystem grow outside the Cosmos IBC (the Archway team is already working on this).

- Innovative use cases leveraging the native Gravity Bridge integration where developers can pull native Ethereum assets such as ERC-20s and ERC-721s into their dApps and bring their own assets to Ethereum.

- Gasless transactions deliver experiences that look and feel like any normal web or mobile application. What use cases will this ultimately unlock and what will the traction and demand for these services ultimately look like? (Hint: gaming/entertainment is usually the niche that is usually referred to as needing “high throughput – low value transactions”.

- How Interchain Security, also known as shared security, and other Cosmos native developments will affect adoption in the cosmos ecosystem and all IBC applications.

To conclude, the Cosmos space is seeing interesting developments, particularly in the space of smart contract platforms. With increasingly distinct solutions being offered by protocols, developers have more levers to pull than ever. Future will tell how and which of these features will be leveraged for avalanche-like end-user adoption.

Unique offering

DISCLOSURE: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND YOU SHOULD NOT MAKE DECISIONS BASED SOLELY ON IT. THIS IS NOT INVESTMENT ADVICE.

Archway links

Website — www.archway.io

Twitter — www.twitter.com/archwayHQ

Discord — https://discord.gg/pnQQHynCDC

Documentation — docs.archway.io

Lightpaper – www.archway.io/lightpaper.pdf

I must thank you for the efforts youve put in penning this site. I am hoping to check out the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has motivated me to get my very own blog now 😉

This is amazing! Now I really get how Archway works and wow you are so skilled in writing and creating models! I really got inspired to take my interest in blockchains further! So thank you for that👏🏼👏🏼🫡